Real estate is one of the sectors which people consider as the necessity as well as investment option. Over the period, real estate has given good ROI on the investment and so is considered as one of the traditional yet effective investment options.

UK Real Estate Market Overview

Growth in the size of the UK economy in terms of GDP has an average of 1.3% until 2019. The growth of the sector in the UK in 2019 remained almost modest at around 1.2%.

Real estate market capitalization in the UK

Let’s talk about the different key figure of the real estate market in UK. As of June 2020, listed office real estate companies had a total market capitalization of Euro 66 Billion. At the same time, the housing companies stood up at Euro 53.9 billion. The 3rd sector in the real estate is the retail sector which is at Euro 20.5 billion followed by industrial, healthcare, and student areas.

Home price in the UK

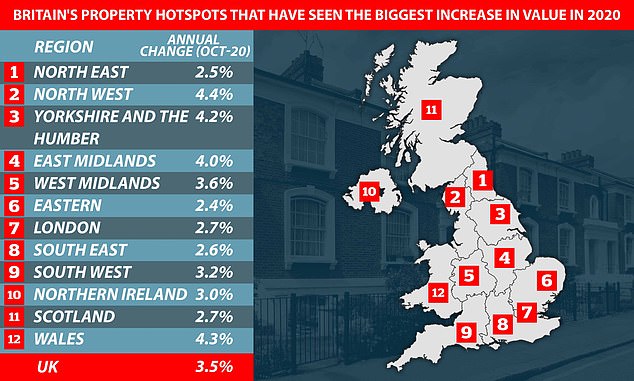

The pricing of the home has varied a lot in the UK and it also varies based on the location in the UK. Since June 2020, the home pricing in the UK has increased by 15000 Euro. Below are some of the major hotspots in this increase-

Overall, the pricing of home has surged by 3.5% since June 2020 where North west and Wales regions have shown highest growth.

Here are some of the major points across the UK home price from 1996 to 2007-

- Home price in London rose by 289%

- North Ireland has seen the highest rise in the price since Q3 1996 to Q3 2007 of 315%

- Price increase for other regions has seen a surge between 187.9% (for Scotland) to 245.5% (outer Metropolitan area)

- The national index rose 240% over the same period

If you will look at the overall pricing trend of UK, then it goes like below from Jan 2015 to Aug 2020-

You can find more details about the pricing here.

Property tenure trend in the UK

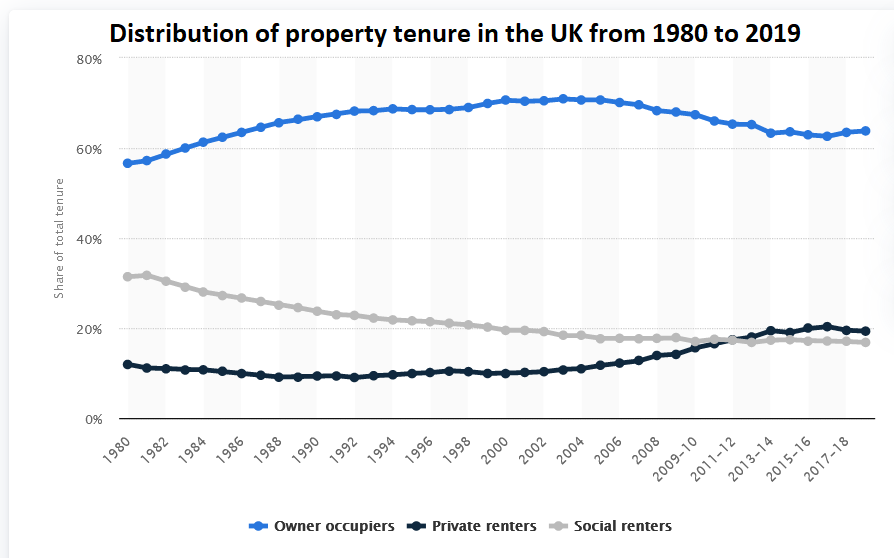

Now let’s talk about the distribution of tenure in the UK from 1980 to 2019. During 2018-2019, around 64% of all houses in the UK was owned and occupied. The renters occupied around 35% of all the tenure. In this 35%, around 19% was from the private sector.

UK Home Mortgage Trend

Total value of gross mortgage lending from 2007 in the UK till Q1 2020 trend like below-

As we can see, the value of mortgage been little fluctuating but on an average it has increased. This confirms the home pricing trend we have discussed above.

If you’re also planning to buy a home and planning for mortgage, then you should plan in advance. The major reason behind this is, you should not take a mortgage which can cause issue to you. Your future happiness should not be on the edge of your current problems.

So, planning the mortgage is a big step and you should do it carefully. There are many online mortgage calculators available online for free which helps you understand the mortgage well. One of such leading sites to calculate the monthly EMI of mortgage, you can find here.

Conclusion

This was all about overview of UK real estate market. Hope you got some ideas about the home pricing and mortgage trend of the UK. If you got any question, feel free to comment below.

Leave a Comment